Safe Money Math Magic

You need Safe Money Math Magic because you have a limited time before you retire and a 30% to 50% loss would be catastrophic.

The two embedded factors that produce the Magic are:

- Zero Basis (during market downturns you may not make any money but you never lose money)

- Annual Reset means the whole time everyone else is trying to recover market losses, you are gaining income on top of your guaranteed principal.

Last year, during the market decline, a close friend lost 30% of her mutual fund set for ‘moderate risk’. However, much of the loss was recovered. So far this year, in this market, she has lost 30%. Had she been able to take advantage of a Fixed Indexed Annuity (FIA), she would not have suffered principal losses.

Because you chose a Fixed Indexed Annuity, indexing your returns with a zero floor means a declining market is very advantageous.

- You lost $0 due to Zero floor while everyone else is rightly worried about how much more they could lose and when is it going to stop.

- The new low point is your new starting point for next year, making you money every year. This is the annual reset feature that also locks your principal and interest every year.

- Each year, you will make money on top of your original principal whenever the market is recovering while everyone else is still trying to recover their losses that will return them to even.

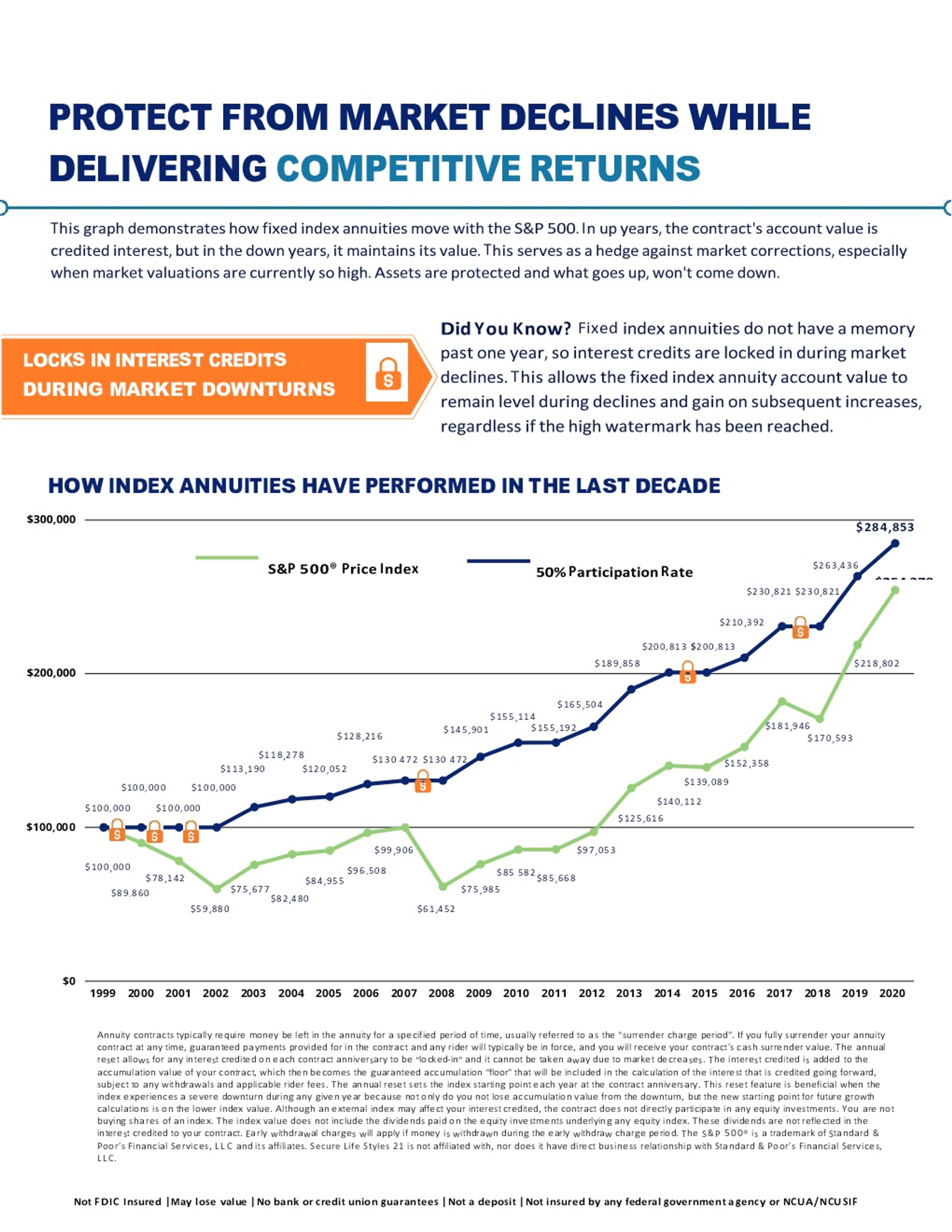

In the chart below, compare the earnings on this investment return study on the Standard & Poor’s 500 Index between 2000 and 2020.

There are two lines. The Green line is the S&P’s ups and downs for the period starting with $100,000 invested. The Blue line is your Hybrid Annuity, counting only half the earnings of the index in any given year.

Apply the Safe Money Math Magic principles and you see in twenty years your Hybrid Annuity Account has more money than the 100% gains of the Index. On the Blue line, we are only crediting ½ of the earnings on the same index to your Hybrid Annuity.

Notice the lock on your account every time the market loses and the graph for the Hybrid Annuity is level. Then notice every time the S&P goes up, your Hybrid Annuity goes up.

Safe Money Magic is only one of the major advantages of using Hybrid Annuities for your retirement.

Being an FIA owner, you are protected from suffering a loss and will make gains during the market recovery period.

Others who invest in the market and mutual funds are not protected and their investments will show growth but will take several years to return to zero.

A look at the S&P 500 index from the turn of this century is a great example.

- June 2001-September 2007 Recovery time was 6 years and 3 months

- March 2007- March 2013 Recovery time was 6 years.

Right now, the market has lost over 30% from its high in 2020.